Bayport Blog

The ultimate guide to Credit Health and Financial Wellness

Published: April 2, 2020

Categories: Debt Relief, Financial wellness

Tags: Credit Health, Debt Consolidation, Debt Counselling, Debt Management, Debt Relief, Debt stress, Financial Health, Financial Planning, Financial Stress, Financial Tips

What is credit?

Credit can be defined as the process whereby one might borrow money from a financial service provider or obtain goods or services from a service provider without immediately paying for it. A credit or loan agreement is signed between the lender and the borrower with the understanding that a payment will be made in future, at agreed terms, usually with interest and other service charges added.

Simply put, credit is when someone borrows money from a credit provider to use now, with the agreement that it will be paid back over time at a cost.

Types of Credit

Credit comes in various forms, ranging from secured and unsecured loans, short and long-term personal loans, short-term loans, consolidation loans, revolving loans and credit cards. It’s important to understand the different forms of credit so that you can make the right decision to suit your needs before you apply for a loan or credit card.

Secured vs Unsecured Loans

A secured loan is when the lender requires you to provide some form of collateral or surety such as an asset (i.e. Home, Car, Policy) as security that you will repay the loan to them in order to reduce the risk on the lender, in the event that you are unable to repay your debt. Usually these types of loans have a lower interest rate as the risk is less to the lender; however if you default on your payments, you stand to lose your asset that was provided as collateral.

An unsecured loan does not require you to provide surety or collateral as security, which means that the lender is assuming the risk and will therefore charge a much higher interest rate than with a secured loan. Because of the higher interest rate, it is not advisable to take out an unsecured loan for high expense items, but rather only for smaller amounts such as personal expenses, studies, medical short-falls and emergencies. While the lender may not require surety, they try to reduce the risk by only providing loans to borrowers who have a good credit standing and a higher credit score.

Personal Loan

A personal loan is money borrowed from a bank, a credit provider such as Bayport Financial Services; or online lender that you pay back with interest in fixed monthly payments or instalments over an agreed period of time. Most personal loans are unsecured.

Personal loans in South Africa usually range between R1,000 and R200,000 with repayment period of up to 72 months (Bayport offers loans of up to R250,000 with repayment terms up to 84 months; risk profile dependent); with interests rates (*APR) of between 15% and up to 27,5%.

Short-term Loan

Short-term loans are popular options for those people who need access to a small amount of money very quickly, and are able to pay it back in a much shorter period which is usually between 1 month to a year.

There are many online short-term loan providers or microlenders who offer reputable services and are registered as formal lenders. They are also regulated lenders. This is not the same as informal and unregulated lenders such as loan-sharks or “Mashonisas”.

It is important to know the difference and to always choose a regulated formal loan provider when considering your loan options.

Consolidation Loan

A consolidation loan is a form of debt restructuring whereby an individual combines all of their debts into a single consolidated loan. So, instead of paying multiple credit providers or loans, they apply for a debt consolidation loan to essentially combine all their payments into one, which often has a much lower interest rate and new terms of agreement with one single credit provider. Often the repayment term on a consolidation loan is longer, which also lowers the amount that needs to paid each month.

This is a great financial solution for those who are struggling to meet their financial obligations each month, and are juggling their loans from month-to-month, trying to avoid being blacklisted. Whether you can qualify for a consolidation loan depends on your credit scores, income, expenses and other financial factors.

Bayport offers a debt consolidation loan to help customers manage their debts better so that they can improve their overall financial wellness and credit health.

Revolving Loan

A revolving loan is a rolling credit facility offered by approved credit providers, that is available to you whenever you need it, without having to re-apply for a loan every time you need to borrow money. Overdrafts are examples of revolving credit, and is also referred to as evergreen loans. With a revolving loan, a certain amount (usually around 15%) needs to be repaid before you can borrow again using the same facility.

There are no monthly repayments, however the interest rate is payable and this amount changes depending on the amount of credit used. The interest rates are generally lower than those charged on credit cards, but are higher than traditional personal loans.

Credit Card

A credit card is a credit facility that allows you to pay for goods or services with a card. The bank that issued the credit card pays the service provider, also known as a merchant for these transactions on your behalf, with the agreement that you will pay the bank back later. It is technically known as a line of credit which is usually limited by the amount that you qualify for depending on your credit standing and affordability.

Credit cards are best when you are looking for a short-term solution that allows you to pay-as-you-go on smaller transaction items. If you maintain your payments on time, a credit card can help you build up a good credit score quickly, however credit cards often have high interest rates and once an initial interest-free period has expired, and if not used responsibly, it could cause a great deal of financial stress. It is not the ideal solution if you need a long-term credit or loan.

*What does APR in Personal Loans Mean?

Annual Percentage Rate (APR) is the cost you pay each year to borrow money, including the interest rate, charges and fees, shown as a percentage. The higher the APR, the more you will pay over the lifetime of the loan. Usually, the shorter the loan period, the higher the APR or interest rate you will be charged, however South African lenders are capped at the maximum amount that a lender is allowed to charge.

The Interest Rate is not the same as the APR as it does not factor in the additional fees and charges for the loan.

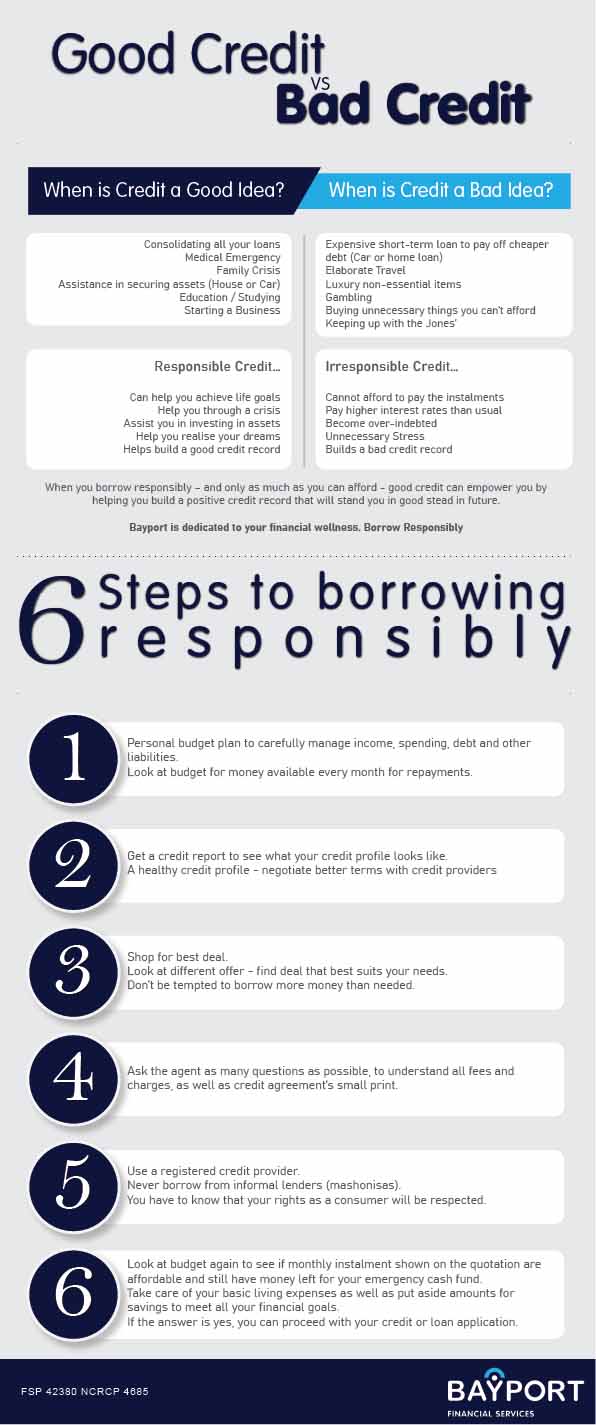

Know the difference between Good Credit and Bad Credit

South Africans are becoming synonymous with the term ‘bad debt’ as the cost of living keeps rising and the Rand to Dollar exchange rate keeps weakening on a daily basis. According to Neil Roets, CEO of Debt Rescue, South African consumers now owe around R 1.6 trillion rand in debt collectively, however there are both good and bad uses for credit.

What is Bad Debt?

There are risks with taking a personal loan, therefore you should think carefully about when and how much you need to borrow. Debt is not the enemy but bad personal finance habits are. It is a bad idea to take out a more expensive loan, such as a short-term loan, to pay off cheaper debt such as a car or home loan which may require a long-term loan.

Also, one should never take out a personal loan to pay for things that you cannot afford, to gamble or to keep up with a certain social status. Credit should never be used for non-essential purchases.

What is Good Debt?

Credit doesn’t always have to be the bad guy, as it is usually made out to be. The one instance where it does make sense to take out a loan to pay off other debt is when individuals consolidate their liabilities. Consolidation loans give you an opportunity to settle your expensive debt immediately and then to service only one loan, which will save you fees and bank charges.

Other good uses are, for example, to buy a large asset, such as a car or a house, or to deal with an emergency, such as an accident or a medical operation. When you use credit well and wisely, it can help you to achieve your life goals.

Good credit can empower you to handle emergency financial situations, such as a medical bill or family crisis, but also enable you to seize an opportunity to invest in assets, such as a home or a business, and realise your life dreams. Importantly, when you use credit responsibly, you build a positive credit record that will stand you in good stead in future.

The advantages of credit

Credit is beneficial for those who have budgeted for repayments and have considered all fees, charges and small print. Reputable and registered credit providers will protect your rights as a consumer and ensure you are fully aware of the financial commitments that come with a credit agreement.

When used correctly and responsibly, credit can improve your life and the life of your family. Good debt can range from anything like a home loan or even a personal loan – how you apply that personal loan however will determine if it is good debt or bad debt.

The disadvantages of credit

Credit certainly has its advantages but also some dangers if not managed responsibly. Consumers should never take on more debt than what they can afford, and definitely not use expensive debt, such as a short-term loan, to service cheaper debt, such as a car or home loan instalment. Rather talk to your credit provider about a payment plan that will help you to restore your financial health without placing you at additional risk.

There are a number of consequences of credit. Credit is not free. To cover the costs and risks associated with extending credit, the credit provider adds interest as well service and initiation fees to the capital amount that you borrow.

Credit can become expensive, hence you should only borrow money when you really need it and then attempt to pay your loan off as quickly as possible. It is also important to make sure that you can afford the repayments for the full loan period. It is hard to recover once you have missed more than one instalment. You could land yourself in financial difficulties if you do not use credit responsibly and within your means.

Does Debt-free Living affect your Credit Score?

Believe it or not, there are some South Africans who choose to live a completely debt-free lifestyle as far as possible. These folks have the perspective that, if you don’t have the money in the bank to pay for it, then you cannot afford to buy it. While a cash-only lifestyle will certainly prevent you drowning in your own debt; it is important that this this lifestyle does not end in you shooting one in the foot.

Cash or Credit?

Using cash to steer clear from debt might be the best way to go when you want to keep your head above water, but what are the implications of not building up a credit score?

Failing to build up a good credit score can see you having limited access to quite a few things in life. Whether you need a place to stay or a vehicle to get you from point A to point B, having a good credit score is essential these days. Buying a car or a house with cold hard cash seems impossible to the average citizen of South Africa. Even if you rent the apartment or house you live in, the landlord or rental agency probably checked your credit score before they handed over the keys to your home.

If you have been living a strictly cash life, building a good credit score will take time and requires discipline.

How a bad credit score affects your life

Having a bad credit score is far worse than having no credit score, however both of these will see you living a limited life, unless you are extremely wealthy of course. A bad credit score will also see you struggling through life. As mentioned earlier, there are certain things that will require you to enter a credit agreement at a certain point in your life. Having a bad credit score will see most financial institutions declining to grant you vehicle financing, a home loan or a personal loan.

How to get a good credit score

- Know your credit status The first step on your good credit score journey starts with knowing your credit status. You can get a credit report at all credit bureaus. Bayport Financial Services also offers a free credit report.

- Pay your bills on time You can improve your credit score by paying bills on time and even trying to pay more than the monthly minimum required payment if possible. Make sure that these bills and accounts are registered in your name – if you pay bills in a timely fashion or make additional payments on your accounts but they are not registered in your personal name, you are working against yourself and wandering off your good credit score journey.

- Have a steady income Factors like how long you have been working at your current job may affect your credit record. Try to maintain a stable and loyal employment history, without interruption and avoid job-hopping to show that you have a consistent and steady income.

- Present a stable proof of residence While your residential address has no direct impact on your credit score, it does appear on your credit report; and if you move house too frequently, it may appear as though you are not stable which could discourage some lenders from granting your credit.

To ensure that you stay on the good side of credit, ask yourself these questions before you borrow:

- What is my reason for wanting to borrow money?

- Is a personal loan really the best way to pay for it?

- Can I afford the monthly loan repayments?

- Is now the right time to borrow money?

- How stable is my job?

Some actions are obviously harmful to your credit record, like paying late (or not at all), or maxing out credit cards. But some mistakes aren’t that obvious and you only realise later on that your credit record has suffered a blow. The right credit at the right time can be a major game changer to your life and your financial well-being. But taking out a loan is never a decision to be made lightly.

6 Steps to borrowing responsibly

Credit can be a tricky thing.

The fact that you qualify for credit, does not mean you are ready to take it up. Individuals who are unprepared for the responsibilities of credit often do more harm than good to their credit profile and end up with more debt than they can handle. The golden rule of credit is to always borrow responsibly. This means taking up only what you can afford, and paying your account on time, all the time.

Once you are sure that you are borrowing for the right reasons, follow these 6 steps to borrow wisely:- A personal budget plan can help you carefully manage your income, spending, debt and other liabilities. Look at your budget to find out how much money you have available every month for repayments.

- Get a copy of your credit report to see what your credit profile looks like. A healthy credit profile means that you can negotiate better terms with credit providers.

- Shop around for the best deal. Look at what different companies offer to find the deal that best suits your needs. Don’t be tempted to borrow more money than you need.

- Ask the agent as many questions as possible, so that you understand all the fees and charges, as well as the credit agreement’s small print.

- Make sure the credit provider you choose is registered. Never borrow from informal lenders (mashonisas) that do not comply with the law. You have to now that your rights as a consumer will be respected.

- Once you have chosen a credit provider, go back to your budget to see if you can afford the monthly instalment shown on the quotation and still have money left to put money away for your emergency cash fund. The aim is to take care of your basic living expenses as well as put aside amounts for savings to meet all your financial goals. If the answer is yes, you can proceed with your credit or loan application.

Emergency Cash Fund

South Africa has a poor savings culture with only 39% of our population having an emergency fund. An emergency fund is an account that is used to set aside funds to be used in an emergency. We live in a time in which the cost of living is constantly on the rise, public and private transportation has become a luxury as opposed to a commodity, and rising food prices constantly make our shopping baskets smaller, filled with less of the products we want and more of the essential day-to-day items.

While an emergency cash fund may be ideal, that can seem impossible for most of us, given how many of us don’t have enough cash on hand to cover even an unexpected emergency. It’s hard enough with so many other wants and needs emptying our wallets.

For instance, these emergencies can include; the loss of a job, an illness or a major expense, urgent payment of school fees and medical emergencies, (buying that designer handbag you have had your eye on should not constitute an emergency). It is also impossible to know how much you would need in a worst-case scenario (picture all of the above, and now the car is making a funny noise).

Try figuring out what you would do if you had a financial emergency and you might discover that you already have some options. Depending on the type of emergency, the amount of funds required and for how long, a credit facility may be your shoulder to lean on in a difficult situation.

Your money and debt management are some of the most important things in your life, since they influence almost everything you do. It is important to be able to distinguish between your needs and wants. Needs are essential goods and services you require in your daily life. Wants are those things you desire.

It is important to use this type of credit responsibly. You need to take an active approach in managing your finances and examining your needs and wants before committing to any form of credit. It is also important to submit accurate personal information and financial details when applying for a loan. Taking out a personal loan can help you relieve your debt load and cover unexpected costs, but take stock of your options before settling on one choice. Borrow only what you need and repay your debts on time and you’ll thank yourself later.

When you pay with cash, you can often negotiate a cash discount. You will also pay less because you won’t pay interest, fees or other charges, and you won’t have to worry about keeping up with repayments.

Applying for credit

There a various financial products that may cater to your needs, for example, medical credit facilities. It is crucial that you weigh your needs and wants against each other before committing to a credit facility.

Tips when applying for credit or a personal:

Bayport Financial Services has compiled a few important points to think about before applying for a loan.

You may qualify to apply for a short term personal loan once you provide all the necessary documentation to show that have a stable cash flow and that you meet the affordability requirements as stated by the National Credit Act.

- It is absolutely important to submit accurate information. For example, when you state your net or gross income, don’t inflate figures to a point that they don’t match what appears on your salary slip (we all go into ‘dream-mode’ when these details are asked). These little details affect your ability to qualify for a loan.

- In addition to submitting accurate information, it is also important to apply for a personal loan only when you are in need of one. Borrow as little as possible so that you can pay more than the minimum instalment every month. If you repay the loan quicker, it will cost you less because of the interest you save.

- If your finances can be managed correctly and you can stick to your budget, then having to apply for several loans at a time should not be the norm for you. It cannot be stated enough that you should borrow responsibly because somewhere down the line if you abuse your line of credit, you may find yourself experiencing difficulty when applying for loans in the future.

What credit providers look at when you apply for a loan

Credit providers want to be confident that the credit they grant will be paid back on time and in full. Therefore, they conduct a credit risk assessment using the following criteria:

- Can you repay the loan? The call on whether or not you can afford to repay the loan on time depends largely on your gross income and expenses. Make sure that after all your expenses and your new loan instalment that you have extra cash in your pocket.

- What does the economy look like? A poor economy might make it harder for you to repay the credit. Credit providers consider factors that might affect your job and income, such as the potential for strikes or retrenchments in your industry. Once you qualify for a loan it is important that the monthly repayment amount still leaves you with extra money at the end of the month as financial surprises like rate hikes can occur.

- Will you pay if you can? Your credit history is the clue credit providers use to determine the risk you might pose to them. They assess your credit profile from a credit bureau and check their own credit records to see how you managed your relationship with them and other credit providers in the past

“How you managed your finances previously will have a big impact on your ability to get a loan in future,” says Mark. “If you have drawn up a personal budget and ensured that you can afford it, credit can be a great way to relieve financial pressure and start building an asset base for your future.”

In the event of you experiencing difficulty in repaying your loan, you should contact your financial service provider immediately so that they can discuss debt management and debt relief options with you to prevent your credit record being negatively affected. A single call can save you a lot of debt stress and help maintain a good credit health and improve your financial wellness.

Loan providers in South Africa are strictly monitored by the National Credit Regulator (NCR) and financial service providers in South Africa are committed to their client’s financial health and future.

Go back