Bayport Blog

Tips to improve your credit score

Published: July 6, 2020

Categories: Financial wellness

Tags: Credit Health, Credit Score/Rating, Credit Wellness, Financial education, Financial Health, Financial Literacy

A credit score is not something we think about every day. It is, however, a very important financial planning tool and an indicator of your credit health. It’s one score you can’t afford to ignore!

To understand what a credit score is, you have to know where it comes from. The answer is credit bureaus. Credit bureaus are companies that gather and store your financial information, update your credit history and compiles your credit profile into a credit report. They use your credit report to work out a credit score for you.

In simple terms, your credit score shows how healthy (or not) your relationship with credit is.

The credit bureaus also sell your credit information to credit providers, such as Bayport, so that they can make decisions on whether or not to grant you a loan. The better your credit score, the more debt solutions are available to you. Remember, however, that a credit provider needs your permission to get your credit information.

Credit bureaus:

- Provide credit providers with accurate credit information that they use to assess loan applications.

- Make it less risky for a credit provider to give credit, or debt financing, to consumers.

- Protect you against over-indebtedness by helping credit providers to lend responsibly.

What is a credit report?

It is a record of your borrowing behaviour, and includes the following information:

- Personal information that identify you, including your name, ID number, all known addresses and telephone numbers and your employment history.

- Details of all the accounts you have with banks, shops, credit card companies and other credit providers.

- Your payment history for every account over the past 24 months.

- Any legal action that have been taken against you for the non-payment of credit.

- Details of everybody who has asked for copies of your credit record in the past year. This means you can see who has looked at your credit report and when. It is very important that you check no enquiries were made of which you were not aware, as this could mean that someone is trying to apply for credit in your name.

- If you have ever been a victim of fraud, there will be a fraud alert on your credit report. A warning will also appear if you are under administration or debt restructuring.

Once a year you can get a free credit report and score.

What is a credit score?

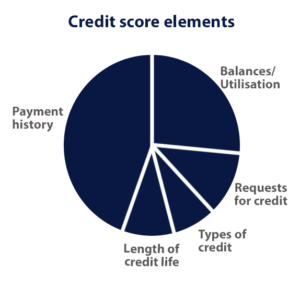

Your credit score is drawn from your credit report, and is made up as follows:

The higher your credit score the better, as it means that you are a low-risk customer to the credit provider. The lower your score, the higher the risk you present to the credit provider. As a financial planning tool, your credit score shows you whether or not you can plan to use credit to achieve your financial goals.

The information does not stay on your credit profile forever, therefore you can improve your credit score by being responsible with credit.

How to improve your credit score

The short answer is that healthy money habits will improve your credit score. Here is what it means in practice:

- Check all the accounts on your credit report. Make a note of the ones you have not been paying according to your agreement, eg, missing payments or paying late. Put a reminder on your phone to make sure you pay the full amount, on time, every month.

- Never use more than 35% of the credit limit on an account or a credit card. For example, if your credit card limit is R5 000, never owe more than R1 750 per month. Similarly, when you take out a loan, do your best to not take the maximum amount for which you qualify.

- Only borrow to pay off debt if it is to consolidate your current loans. In all other circumstances, it is a very bad idea to borrow from one lender to pay off another.

- Negotiate payment arrangements with your creditors if you struggle to keep up with your repayments, and stay away from monthly cash loans.

- Maintain a healthy mix of credit, such as retail accounts, credit cards, a home loan, and service contracts such as for a cell phone. This helps to establish a strong credit history.

- Do not shop around for multiple lines of credit at the same time. Every time you apply for a loan, the credit provider runs a check at the credit bureau. Too many applications at the same time could indicate that there has been a significant change in your financial situation.

- Check your credit report and your credit score regularly so that you can dispute any mistakes or information that you don’t agree with.

You should take great care to protect your credit health, which means keeping your credit score as high as possible. The way to do it is through healthy money habits that come from good financial planning.

Go back