Bayport Blog

Financial freedom is more than money

Published: April 1, 2022

Categories: financial literacy, Financial wellness

Tags: Financial education, Financial Literacy, Financial Tips

One day, when I have enough money, my life will be perfect and I will be financially free. If this is how you think about financial freedom, then we have news for you. Financial freedom starts with your mindset, not with how much money you have.

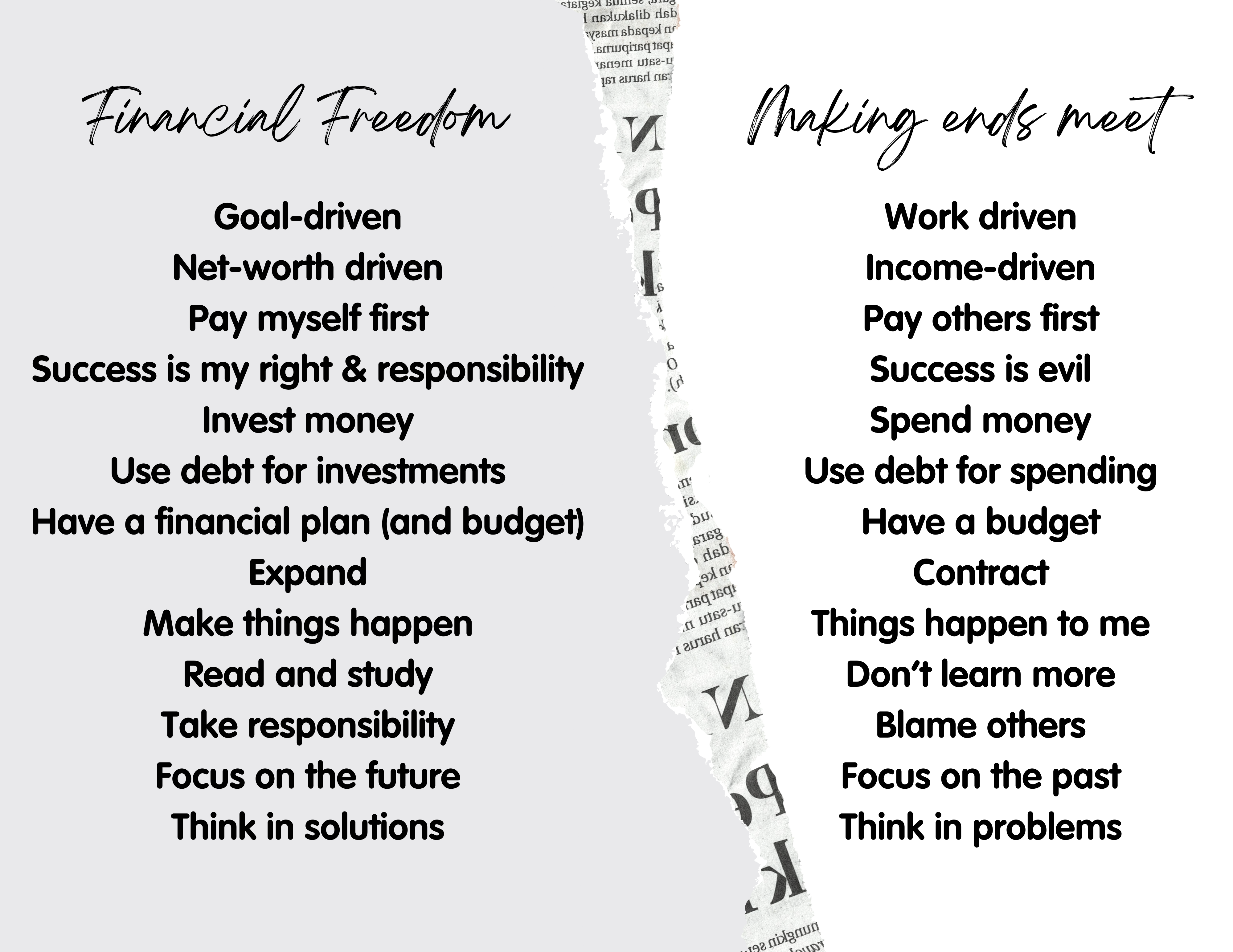

First and foremost, financial freedom is about taking ownership of your finances – something you will struggle to do with an unhelpful mindset. There is a big difference between a mindset of financial freedom and one that focuses on making ends meet.

Can you see how different the financial-freedom mindset is? And how empowering? Now let’s look at some practical steps you can take to achieve financial freedom, regardless of where your finances are right now.

1. Understand where you’re at

Start by adding up your debt, and then make a list of your savings and investments, including your company retirement fund. Next you add your income, such as your salary, earnings from a side hustle you might have and other funds coming into your households, such as government grants.

The difference between your assets (savings and investments) and liabilities (debts) is your net worth. Your financial-freedom goal is to grow that number.

2. Look at money positively

Remember that money is a good thing, even if it seems to cause you a lot of problems and anxiety at the moment. Try thinking about money as a necessity like food or water; it is neither good nor bad, it is simply something you need.

Why is this important? If you view money negatively, you’ll subconsciously sabotage your chances of making it and keeping it.

3. Write down your goals

You have to know why you want more money – eg, own your own home, give your children the best possible education, or take your partner on a safari or boat cruise for your 25th anniversary – and how much you want. Knowing exactly what your goals are and why they matter, makes achieving financial freedom a million times easier.

4. Track your spending

Before you can redirect your spending, you have to know where your money currently goes. It is easy to believe that you don’t have any spare cash to put into savings, but once you know just how much you spend on drinks with friends, for example, you can start making different spending decisions.

5. Pay yourself first

This means putting a specific amount of money in your savings account before paying anything else, even bills. By paying yourself last, you only get whatever is left over, which usually isn’t enough to get you to financial freedom.

6. Spend less

By spending less, you’ll have more money to put aside for your financial freedom. In this process, you will also learn that you need a lot less stuff to survive, which also helps you put aside more money.

7. Buy experiences, not things

What’s your happiest memory? What were you doing? Who were you with? Instead of buying stuff, think about making more memories like these.

8. Get rid of bad debt

Speak to Bayport about debt consolidation – a powerful way to bring your debt under control and increase your monthly cash flow at the same time. Even if you can afford all your monthly repayments, focus on paying off your most expensive debts and use that money to grow your savings and investments.

9. Create additional sources of income

Get someone to rent your spare room, turn your love of baking into a business, or sell vegetables from your garden to your neighbours.

10. Invest in your future

This means saving for retirement and building up an emergency fund so that you don’t have to go into debt or use your financial-freedom savings to deal with an emergency.

For more information visit: Information Centre Go back