Case study

Industry: Motor vehicle manufacturing

Company: Toyota (Boshoku)

In 2019, Bayport’s wellness programme partnered with Toyota (Boshoku) to assist a significant portion of their employees that fell into the high to very high credit risk bracket that would not normally qualify for loan products at most reputable credit providers. Since January 2019, more than one hundred and sixty Toyota employees have been assisted with R8m in loans.

A total of R2,1m of employee debt was reduced by means of discounted settlements negotiated by our financial coaches and wellness programme staff.

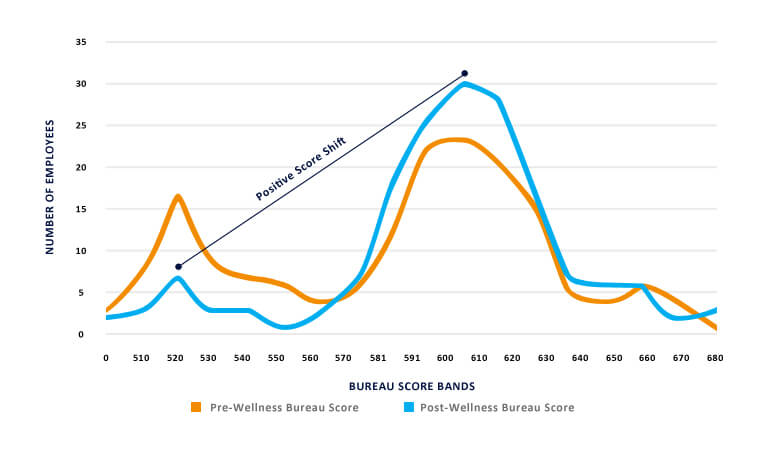

Positive credit score shifts after debt

consolidation

The below graph showcases the gradual improvement of Toyota "employees" credit scores, moving from left (high risk) to right (lower risk). This was especially evident in the group of "employees" that were initially categorized as high risk with credit scores of 570 and below.

Improving bureau scores

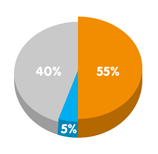

55% of employees’ credit scores improved post Bayport’s wellness programme by means of debt consolidation

5% of employees’ credit scores deteriorated (it is assumed that these employees were not a part of the Bayport wellness programme)

45% of employees’ credit scores remained the same and are expected to further improve over the next 12 months

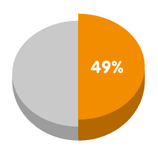

Reducing arrears

49% of employees in South Africa have at least one account in one-month arrears and this was no different at Toyota.

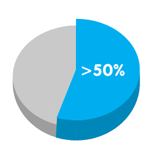

After financial wellness assessments and coaching, more than 50% of employees on the wellness programme were able to change the arrears status of their accounts.

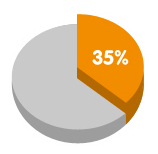

Pre consolidation:

35%

of employees had arrears of 5% or less of their total loan balance.

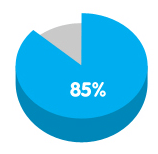

Post consolidation: 85% of employees have arrears of 5% or less of their total loan balance.

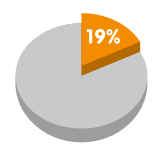

Pre wellness

programme: 19%

have 0 arrears.

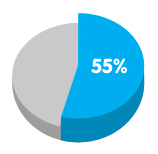

Post wellness

programme: 55%

have 0 arrears.

Contact us

Your information is important to us and where we gather your information it will be in accordance with our information Privacy Policy